(LifeSiteNews) — With a mounting financial crisis in the banking sector, and the end of the U.S. dollar as the world’s default reserve currency in sight, the time has come to name the elephant in the room.

The fundamental evil at play here is the modeling of big government spending on a debt system. These vast debts attracts interest payments.

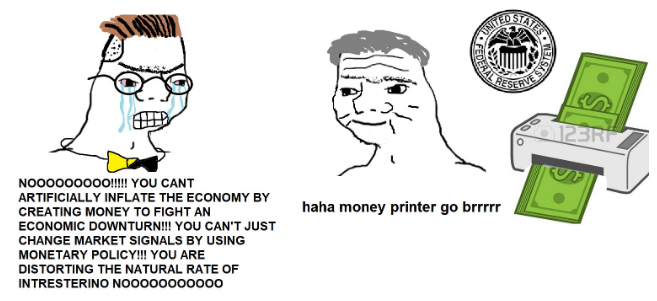

Imagine you are the government. How do you fund your massive military-industrial complex, sprawling secret state, your corrupt schemes, payoffs, regime change operations, and mass-scale propaganda machine? You print money and invent a means to shrink it in value afterwards.

With such a clever trick you can simply make money out of nothing, before making your massive debts diminish — by printing more!

This 100% safe and effective remedy for a disease you invented yourself may have some minor side effects, such as the destruction of the middle class, widespread economic collapse and the obscene enrichment of misanthropic elites. But hey! It’s only money.

A Revenant Evil

It is a matter of simple arithmetic that if you are a government with trillions of debt the best thing you can do is to devalue your currency whilst keeping interest rates low. This will make your own people’s money worth less, but who cares about them?

What matters is that there is a means to fund your endless corruption. Happily, his also weakens the very people who might otherwise oppose you, were they not desperately trying to survive your attempts to ruin their lives.

READ: Already worse than the 2008 crash, the current banking crisis risks going global

In the digital age the evil of usury seems an anachronistic notion – rather like objecting to guitars over the relative merits of the lute harpsichord. Yet this traditional Catholic interdiction is one which we would be wise to revive. That it has so little currency shows how depraved we have become.

Much of the misery of modern mass society is driven by government addiction to debt. How grave a moral evil is the lending of money at interest? It is a wickedness which makes for the ruin of nations.

Inflation Since Fed Creation

Constantly rising inflation has been a permanent feature of the U.S. economy since 1913, when the Federal Reserve was created to print money to service government borrowing.

It has averaged at 3.4% since then, never falling below zero. Previously inflation was around 0.4% on average from the foundation of the republic to 1913. Inflation did occasionally soar, but it then fell well below zero, correcting prices and returning them to “normal.”

A 1913 dollar is worth over $3,000 USD in today’s money, which means the dollar is now 0.03 cents compared to the pre-Fed buck. It has lost five orders of magnitude of value in 110 years.

The Inflation Game

Inflation is the result of central banks printing money to devalue currency and thereby degrade the cost of vast sums borrowed at interest.

The use of interest rates to “control” inflation is a dangerous game, as it raises the cost of borrowing past, present, and future, and makes the purchase of treasury bills, notes, and bonds less attractive.

The president of the Pontifical Academy for Life (PAV) has described assisted suicide as sometimes being the “greatest common good concretely possible” contrary to the Catholic Church’s strenuous condemnation of the practice.

This betrayal of the Catholic faith by Archbishop Vincenzo Paglia is not for the first time, with the PAV repeatedly causing scandal under his watch by:

- recently appointing a notorious pro-abortion atheist to the organization

- claiming contraception and artificial insemination are sometimes acceptable

- insisting that priests could accompany people through assisted-suicide, and

- that Italy’s pro-abortion law is a “pillar” of the country’s social life.

SIGN: Pope Francis must remove Abp. Paglia from the Pontifical Academy for Life

“Personally, I would not practice suicide assistance,” Archbishop Paglia told an Italian journalism conference last week, “but I understand that legal mediation may be the greatest common good concretely possible under the conditions we find ourselves in.”

Accepting an anti-life Italian court ruling that specified when assisted-suicide is permitted, the archbishop claimed “it is not to be ruled out that in our society a legal mediation is feasible that would allow assistance to suicide under the conditions specified by Constitutional Court Sentence 242/2019…”

From the outset of his presentation in Perugia, Paglia also undermined the authority of the Catholic Church on matters of faith and morals, stating: “First of all, I would like to clarify that the Catholic Church is not that it has a ready-made, prepackaged package of truths, as if it were a dispenser of truth pills.”

SIGN: Abp. Paglia must be removed from the Pontifical Academy for Life

The PAV issued a statement on Monday trying to clarify the archbishop’s remarks, insisting that Paglia “reiterates his ‘no’ towards euthanasia and assisted suicide, in full adherence to the Magisterium”.

However, far from denouncing Paglia’s words, the PAV unsurprisingly supported its president. Referencing the Italian court ruling which partially decriminalized euthanasia by outlining exceptions to its illegality, the PAV stated it was in the context of this ruling that Paglia had made his comments.

In this precise and specific context, Msgr. Paglia explained that in his opinion a ‘legal mediation’ (certainly not a moral one) in the direction indicated by the Sentence is possible, maintaining the crime and the conditions under which it is decriminalized, as the same Constitutional Court has asked Parliament to legislate.

The PAV’s fudging of the issue was met with consternation from several Catholic commentators, with liturgist Matthew Hazell, who had highlighted Paglia’s original comments, asking “How hard is it for the @PontAcadLife to just say ‘sorry’ for scandalising the faithful? Indeed, how hard is it to actually adhere to the teaching of the Church on life issues? Are you so incapable of reading the signs of the times & interpreting them in the light of the Gospel?”

The Pontifical Academy for Life has tried & failed to explain @monspaglia‘s remarks. Paglia had spoken about the “accompaniment” needed for the dying, saying “in this context, it is not to be ruled out that in our society a legal mediation is feasible …” https://t.co/C3LU601aA2

— Michael Haynes 🇻🇦 (@MLJHaynes) April 24, 2023

Sorry guys, not good enough. Nowhere near good enough.

Archbishop Paglia’s “opinion” on the possibility of “juridical mediation” regarding euthanasia is still contrary to the Catholic faith, as has been explained already. https://t.co/qMATq0UZrL pic.twitter.com/W8s4zLvkj7— Matthew Hazell (@M_P_Hazell) April 24, 2023

Archbishop Paglia’s comments about assisted suicide being “feasible” are wrong and harmful. It’s the kind of “crack in the wall” that opponents of human life will run with to promote their agenda. The teaching of the Church is clear: Euthanasia is “morally unacceptable.” Period.

— Bishop Thomas Tobin (@ThomasJTobin1) April 24, 2023

SIGN: Abp. Paglia’s presidency of the Pontifical Academy for Life is untenable

It’s vital that the Church and PAV push back against the culture of death, rather than trying to accommodate it and accept a world that where the vulnerable are helped to kill themselves.

Be part of pushing back against the tide and making it clear that there is no room for confusion or betrayal when it comes to the sanctity of human life and the infallibilty of Catholic teaching on the matter.

SIGN AND SHARE THE PETITION WITH FRIENDS & FAMILY

MORE INFORMATION:

Abp. Paglia defends assisted-suicide as ‘greatest common good possible’ for dying people – LifeSiteNews

The Dollar — No Longer a Safe Bet?

At the moment, U.S. bills and notes (short term maturity IOUs) are being dumped by major holders such as China and Japan.

Bonds have a longer maturity of up to 30 years, and they are being bought in the belief the Fed will not continue to raise rates. Government bonds are debt notes and are seen as a safe investment provided the economy does not collapse.

READ: Banking crisis continues: FDIC sells failed First Republic Bank to JP Morgan Chase

No Return to Confidence in Sight

What is of particular concern is the derivatives market, which might be valued at over one quadrillion dollars worldwide.

U.S. liabilities in this market, which is a means of making a bet on the future market value of debt, amount to an estimated 400 times the size of the economy. No one really knows how big the derivatives market is, because this sort of thing is inflated and deflated by talking about it.

The value of the dollar lies in the confidence of the sustainability of the debts “leveraged” on it through “complex financial instruments”. They are not complex and they are bets. It is a gamble whose practice, along with “inflation,” determines the value of the chip.

This is the reason why “money printer go brrr” and why usury, the ruin of nations, is a mortal sin.

Government vs. the People

What is “good” for the government is terrible for you, for the value and security of your assets and wages, and for your nation.

The enormous leveraging of debt — borrowing money on the confidence in the U.S. government to honor its existing debts — has led to a complex system of largely automated financial trading which no one person can explain — or control.

The money-printing inflation model, backed by computer confidence swaps, allows governments to fund massive experiments such as lockdowns.

That our economy and the future of our nations are being gambled away so that today’s managers can spend money that no one has is itself an outrage.

It is compounded by the fact that most of the money which is printed is handed to existing billionaires, woke corporations, and elites whose common interest seems to be the destruction of the quality of life of ordinary people.

The Wages of Sin

In short, debt funds evil. COVID borrowing, the vast wealth transfer to the ultra rich under lockdown, and the endless and devastating wars are all financed in this way. We are paying with our freedoms and our financial prudence to literally destroy ourselves — economically, morally, and spiritually.

Consider the words of President Joe Biden, whose absentee ballot count is an object lesson in the evils of inflation. Speaking of his — and U.S. Treasury Secretary Janet Yellen’s — complete absence of a plan, he boasted that “these actions are going to make sure that the banking system is safe and sound.”

The Return to Reality

In reality, money printer cannot indefinitely go “brrrrrrr.” Whilst there remains a human factor in finance, reality — in the form of depositor confidence — still has a say.

The only means by which the debt-inflation model can continue is to remove the human factor by the replacement of cash. Total state control over a government-issued digital currency would prevent people from making wise decisions about the safety of their own money.

READ: The demise of the US dollar has begun. Prepare yourself and your family now

Freedom is the Enemy of the Regime

This is an important demonstration of the point that the current form of government sees the people as its enemy.

It is the actions of free people which undermine its debt-inflation system, by which it finances corruption.

It is the freedom to speak, to name things accurately, which endangers an ideology that could not survive an argument.

This is the reason we distrust the government and its institutions — whose grip on power is determined not by competence, but by the degree to which it can convince its own populations that reality is not real.

With this mounting financial crisis, the regimes of the West face an even greater humiliation than narrative collapse.